Bold Moves

In this week's blog, which once again explores the world of housing conundrums and developer difficulties, we turn to the paradoxical nature of our planning system and ask ourselves: how can our antiquated system be future-proofed without shifting the burgeoning cost burden onto the very people the system is meant to assist? Councils across the UK will soon have the freedom to set their fee structures, but with no commercial incentive to increase application levels, only to create a smoother, more efficient process for the state, could cost recovery from increased processing just further stifle the system, and how will that affect smaller developers already stretched budgets?

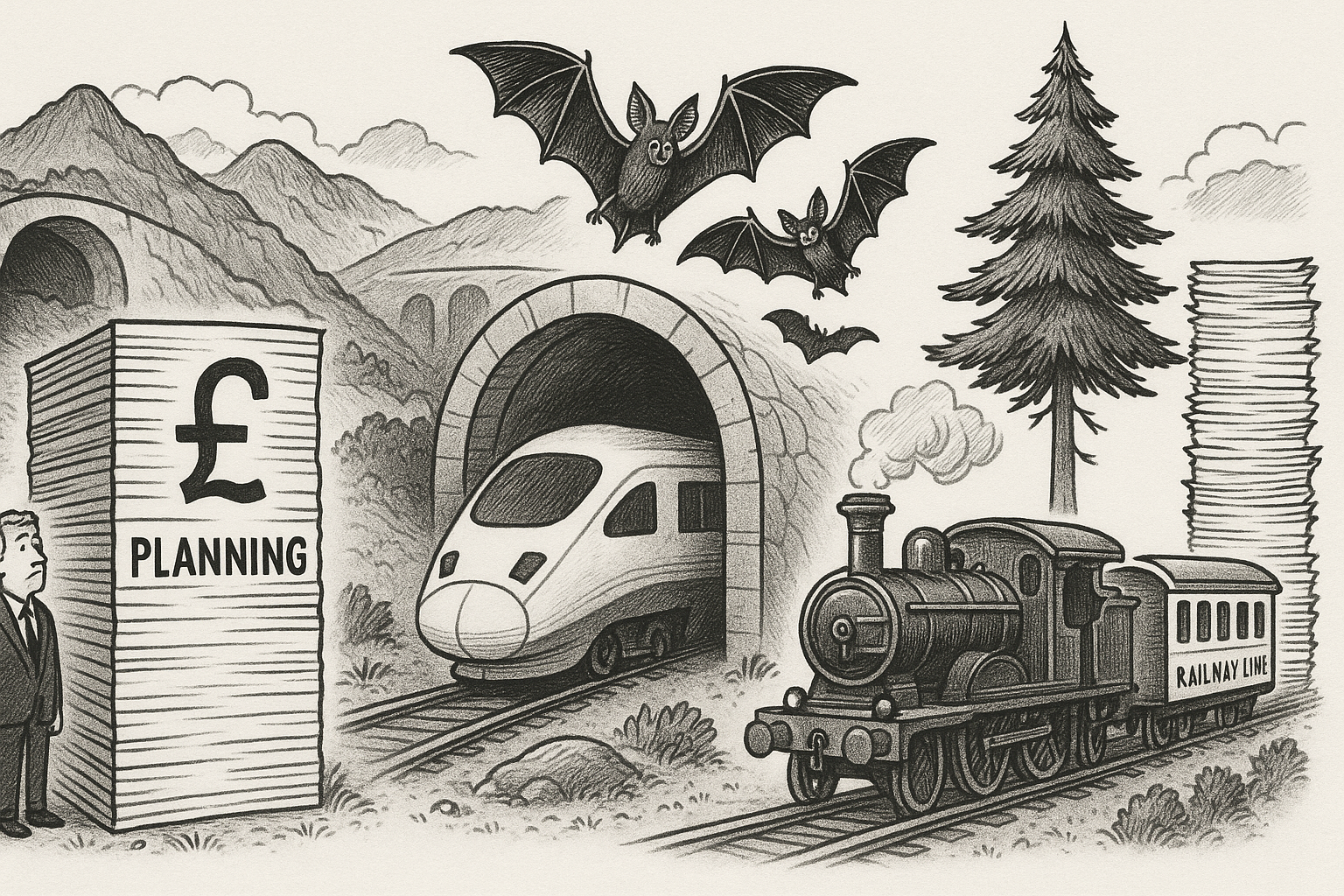

In one extreme example of excess on a national level, Sam Richards, the CEO of lobby group Britain, Remade, in his testimony before the Planning and Infrastructure Bill Committee, pointed out some extreme examples of the system feeding on itself, citing the £250mil spent on planning for the Lower Thames Crossing, more than it cost to build the longest tunnel in Norway, HS2 where £121 Million has been spent on a tunnel for bats before a tunnel for humans could even be considered, and the Portishead to Bristol railway line that had an 80,000 page accompany planning piece, with 1000 pages again dedicated to Bats. In perspective, the 23km of paper for that planning application would have consisted of around five full-size Pine trees. These extreme cases of wastage fall well outside of localised SME development, but they illustrate an important point: are they examples of a system that resists development to represent other interests and soft peddles schemes into dust, death by a thousand cuts, or is this just a by-product of a system that by its very design feeds on itself, it just organically requires a tremendous amount of revenue raising paperwork to function? Substantial financial outlays without any tangible outcome or certainty are embarrassing when it comes to critical infrastructure and make a good headline, but when it comes to smaller businesses, it's vital; it can put projects out of contention before they even begin and isn't conducive to the success of the government's goals around housing.

So, what solutions are being proposed?

In a bold move to tackle the UK's chronic housing shortage, the government has announced a series of planning reforms aimed at accelerating delivery, reducing costs, and unlocking previously underutilised land—particularly for small and medium-sized enterprises (SMEs). These changes, aimed at streamlining bureaucracy and boosting supply, could mark a turning point for both local housebuilding and finance ecosystems. One of the most significant changes is the acceleration of planning decisions for minor developments—specifically, those of up to nine homes. Under the new rules, these small sites will no longer be subject to lengthy delays by planning committees. Instead, expert planning officers will handle approvals, cutting decision times and uncertainty for developers.

In addition to quicker planning outcomes, minor developments will benefit from eased Biodiversity Net Gain (BNG) requirements. This not only reduces red tape but also enables smaller sites to proceed without being caught in the exact environmental compliance costs that typically challenge larger projects and, in the case of the above example, quickly spiral costs out of control. A new 'medium site' category—defined as developments between 10 and 49 homes—has also been introduced. These sites will see simplified regulatory processes and enjoy specific cost-saving exemptions, including relief from the Building Safety Levy. BNG requirements will also be streamlined, making it easier for developers to incorporate nature-friendly design without undermining project viability. The goal is to ensure that environmentally sustainable housing and development go hand in hand, particularly in suburban or edge-of-town areas, where such medium-sized schemes often have the most significant impact.

Addressing the longstanding land-access challenge for SMEs, Homes England will release more government-owned plots exclusively for smaller builders. Complementing this is the creation of a new National Housing Delivery Fund—expected to be confirmed in the upcoming spending review. This fund aims to provide long-term financing options such as revolving credit facilities and lending alliances that match the more flexible and bespoke funding needs of small developers.

So what does this mean for us?

These reforms are a catalyst for growth. Faster planning decisions reduce project delays—a key risk factor in property lending. Simplified regulations and better access to land make it easier for SME developers to identify viable projects and bring them to market quickly. Meanwhile, the enhanced availability of long-term financing options creates opportunities for platforms like ours to align our lending solutions with government-backed initiatives.

In short, the new planning landscape will likely see a surge in borrower demand, diversified project pipelines, and improved delivery timelines—making it a fertile ground for platforms like ours to thrive while contributing meaningfully to the UK's housing challenge.

Invest & Fund has returned over £300 million of capital and interest to lenders with zero losses, showing the rigour that governs our business.

To take maximum advantage of this robust and exciting asset class, please visit www.investandfund.com

Don't invest unless you're prepared to lose money. This is a high-risk investment. You may not be able to access your money quickly, and are unlikely to be protected if something goes wrong. Take 2 minutes to learn more.