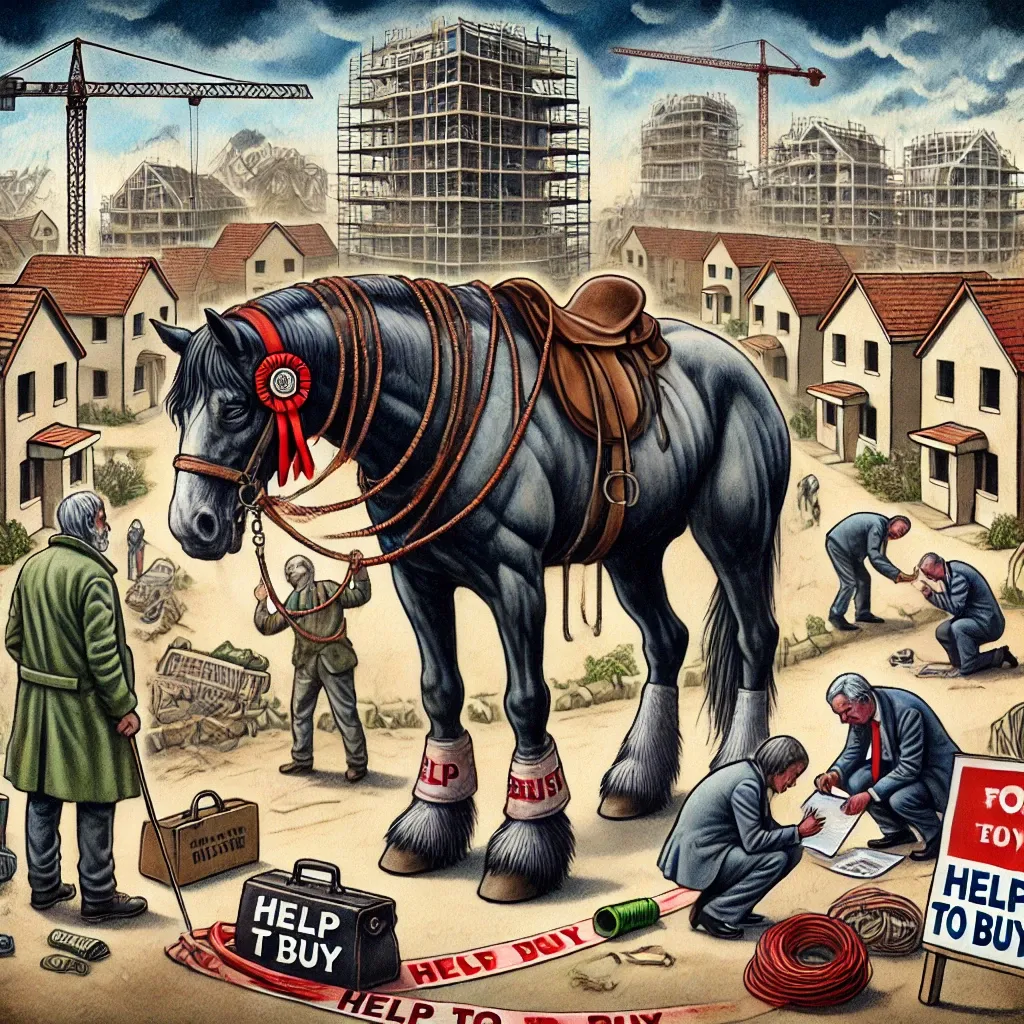

Dead Horse

In this week's blog, we examine some of the most pressing issues facing the UK housing market and suggest that, rather than continuing down the current path, more radical thinking may be necessary to foster positive change. This thinking may involve a complete shift in the approach to aligning investor capital with housing market demand. The reality is that for every hundred houses built, an indeterminate amount of money will also be needed to enhance infrastructure and services. Thus, nationally, as you may have seen in the press, we are discussing the creation of new towns, not just new houses. To achieve this, government policy can only take us so far; ultimately, we will require fundamental structural change. To truly succeed, we need a fully decentralised approach to housing policy, with the investment sector collaborating directly with local governments to address local needs. We do not arrogantly propose that the P2P model is the sole solution; operating as a magic talisman between the public and private sectors, it is merely one of countless solutions that must be implemented simultaneously. However, the ideology of P2P- the idea of removing excess weight from an outdated system while retaining only the necessary components - may indeed need to be adopted.

The "dead horse theory" originates from a proverb attributed to Dakota Native American tribal wisdom. It states that "when you discover you are riding a dead horse, the best strategy is to dismount"—meaning that when you realise a plan or approach is failing, the best course of action is to stop pursuing it and move on to something else. This concept is often used in corporate and governmental decision-making to illustrate the absurdity of persisting with ineffective policies. Despite its humorous origins, the theory resonates deeply with many systemic crises, including the ongoing UK housing crisis. The UK housing market has been plagued by rising prices, a lack of supply, inadequate policy interventions, and affordability issues; yet successive governments have failed to implement truly transformative measures.

The Dead Horse Theory suggests that when a strategy is clearly failing, rational actors should abandon it rather than persist in the hope that it will miraculously begin to work. Instead, many apply increasingly convoluted solutions that only serve to prolong failure. These may include "Buying a stronger whip" – intensifying efforts without altering the strategy, "Appointing a committee to study the dead horse" – commissioning research instead of taking action, declaring "this is how we have always ridden horses" – resisting innovation due to tradition; blaming external factors for the horse’s death – attributing failure to forces beyond our control; and the old corporate staple of hiring consultants to attempt to revive the horse.

You could argue that even though there has been no intentionality here, applying this framework to the UK housing crisis reveals striking similarities in historic policy responses. These responses have often been reactive rather than proactive, exacerbating the very problems they aim to solve. One of the most notable examples of flogging a dead horse, critics may suggest, was the Help to Buy scheme. Introduced to assist first-time buyers in getting onto the property ladder, the scheme provided government-backed loans to help people purchase homes with smaller deposits. However, rather than improving affordability, it drove up house prices by increasing demand without addressing supply-side issues. The policy effectively put more money into a broken system rather than fixing it.

The second and perhaps most notable issue regarding construction is the UK’s planning system, which has been widely criticised for its rigidity and inefficiency. The Green Belt policy, intended to protect rural areas, has limited development in crucial locations where housing is most needed. Instead of reforming the planning system to enable sustainable development, successive governments have mainly upheld restrictive policies, worsening the supply shortage.

Despite the growing demand for affordable housing, the UK has consistently failed to build enough social housing. Right-to-buy policies, introduced in the 1980s, drastically reduced the stock of council housing without adequate replacement. Even when councils have been given more flexibility to build, restrictive funding mechanisms and bureaucratic red tape have stifled progress. Rather than adopting a large-scale house-building program, governments have relied on piecemeal measures that fail to address long-term needs.

The UK government has periodically introduced changes to Stamp Duty to stimulate market activity. However, these measures often provide short-term relief without addressing the underlying issues of affordability. For example, temporary tax holidays create artificial surges in demand, resulting in price spikes that make homes even less affordable in the long run. This approach exemplifies the’ dead horse’ strategy of making superficial adjustments instead of tackling fundamental issues.

So how do we move on from the deceased horse, say our goodbyes, and move on? To break the cycle of ineffective policies, the UK must embrace bold, systemic reforms. We need mass social housing development – a large-scale commitment to building affordable, high-quality social housing that would provide long-term stability for renters. We need a complete teardown and rebuild of the planning system – streamlining planning regulations and encouraging sustainable development in high-demand areas. We also need land value taxation – implementing policies to discourage land banking and promote efficient land use for housing. Also, as previously mentioned, we require the decentralisation of housing policy – allowing local governments more control over housing decisions to address regional disparities. Lastly, and most importantly, we need a system designed to support small developers and the network of businesses that assist them, focusing on those engaged in transformative change within our sector and beyond.

Invest & Fund has returned over £300 million of capital and interest to lenders with zero losses, showing the rigour that governs our business.

To take maximum advantage of this robust and exciting asset class, please visit www.investandfund.com

Don't invest unless you're prepared to lose money. This is a high-risk investment. You may not be able to access your money quickly and are unlikely to be protected if something goes wrong. Take 2 minutes to learn more.