IFISA returns provide stability in volatile times

Bob Dylan once said that 'there is nothing so stable as change'. Unfortunately, in the changing investment market, significant change often meets the desire to seek out a stable return. Volatility may breed opportunity for some, but it can often leave retail investors dizzy with choices in the boom-and-bust whirlwind of complex financial markets.

For the modern investor, inflationary worries have been forefront. With the high rates and high inflation of the previous decades-long in the rearview mirror, the very concept of traditional banking & savings products performing poorly is unpalatable let alone negatively. Chasing returns down the rabbit hole can be equally paralysing; poor performance is preferable to a potentially severe capital loss in most instances.

The simple fact of the matter is, many investments can't offer the stability and consistent returns on offer from a risk-adjusted property-backed asset class.

At Invest&Fund we have a long-held belief in the stability that our asset class can offer. As a result, it's now the go-to for investors looking for yield that will cope with inflationary world events. It's also the obvious choice for consumers not wishing to take on the slings and arrows of outrageous fortune in the markets. This is also recognisable in statistics published by HMRC, revealing the hundreds of millions that flooded into these assets during the pandemic.

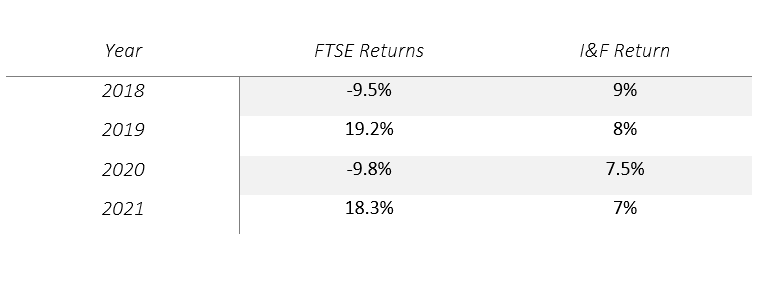

What's been exciting to see is the recent statistics published that back up our claims. For example, looking at the FTSE all share total return index, it's been pointed out that P2P as a standalone asset class outperforms it averaging out the volatility, and taking the good and bad years into account.

So we decided to measure these results against our performance. So, on a £20,000 investment over the above timeframe, the investor in the illustration would end up over £4000 better off with our p2p asset class investment.

There has never been a better time to consider an IFISA through Invest&Fund.

With an exemplary record of capital and interest protection, consistent, attractive returns on offer above inflation, and the whole concept underpinned by the housing market's strength, this is the sensible, stable, tax-efficient investment every diversified portfolio should have.